Client organizations who are considering investing in SLIM® (a top-down, scope-based, parametric software estimation tool) often ask us for return on investment (ROI) case study examples which we gladly provide to help them with their business case. However, one question that has never been asked but I have always wondered is: does ROI accelerate with increased investment or does it follow the law of diminishing returns?

To answer this question, we looked at seven software estimation ROI case studies that included a variety of small, medium and large clients, from a single seat of SLIM all the way up to an enterprise Estimation Center of Excellence (ECoE).

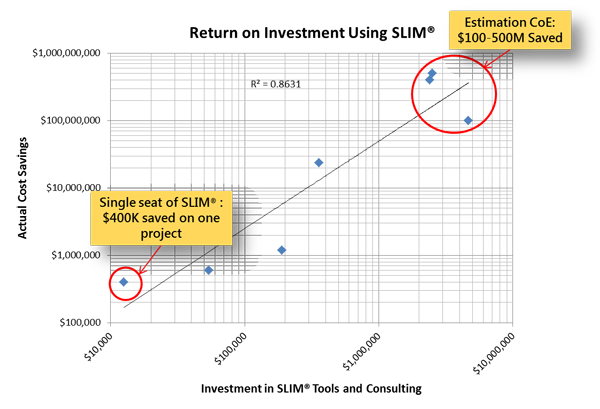

On the above chart we plotted the investment in SLIM tools and consulting on the X axis vs. the return (actual cost savings) on the Y axis for each case study using a logarithmic scale. We then drew a trend line through the data points.

Following the trend line, small engagements (~$30K) had an average ROI of more than 13:1. Medium engagements (~$300K) had an average ROI of 33:1. Large ECoE engagements ($3M) had an average ROI of 67:1. So not only is the ROI compelling, but it also accelerates with increased investment.

The actual cost savings (return) as reported by, or observed while working with, our clients include:

- General:

- Optimizing team size and resource capacity management as part of project portfolio management

- Reducing percentage of software project cost overruns and schedule slippages

- Reducing dollars out of financial control

- Reducing time to complete software estimates from months to days

- As a supplier:

- Avoiding loss of margin from inaccurate fixed price bids

- More responsive sales (resulting in more closed deals)

- As an acquirer:

- Avoiding being overcharged by bidders

- Avoiding “lowball” bidders who are unable to perform

- Getting troubled software projects back on track or cancelling them before sending more good money after bad

- In a risk assessment oversight role:

- Successfully resisting political pressure to implement a high-risk project with productivity assumptions in the impossible zone

We were conservative in calculating the financial return for these seven case studies and only used numbers that were easily defensible. These same clients realized many other benefits which include:

- Ability to quantify how much functionality can be completed in a fixed timeframe

- Improved predictability.

- Reduced disruptions to stakeholders from late delivery

- Increased stakeholder confidence in software project plans

- Increased accuracy in IT resource demand management

“Great ROI, so what’s the catch?”

It’s true that there is no investment without risk. In fact, there is no business without risk. That is why the SEC requires mutual funds to remind investors that past performance does not guarantee future results. However, let’s take a closer look at the risk associated with investing in SLIM tools and consulting. The worst case scenario is that a client gets no return whatsoever, so they lose the money invested in license and consulting fees. However, in QSM, Inc.’s 35 year history, not a single client, after putting in a good faith effort to use SLIM, has requested a refund of our fees. In other words, this is a low risk investment.

“Our budgets are tight right now. Improving our software estimation process is not a priority right now.”

Really??! What other internal investments do you have than can yield an ROI of 13:1 or even 67:1? It’s not a question of whether you can afford to invest in improving the estimation with a parametric tool like SLIM, but whether you can afford NOT to. Low risk + accelerating high return = no brainer.